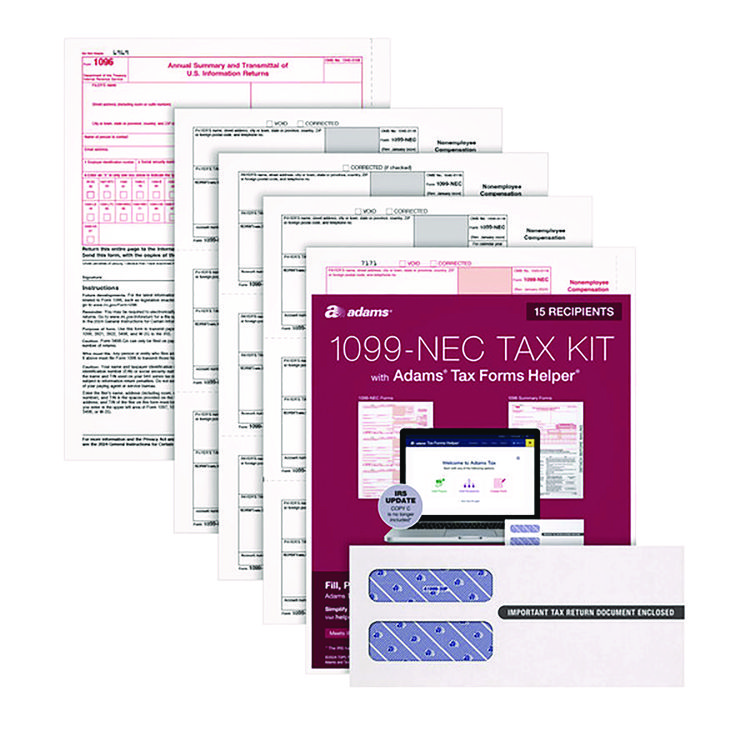

Adams 4-Part 1099-NEC Tax Form Kit with Security Envelopes and Tax Forms Helper, 2024, 8.5 x 3.66, 3 Forms/Sheet, 15 Forms Total (TOP22906KIT)

$15.28

Out of stock

Get Your Order in 1–2 Business Days Anywhere in the U.S. No Delays

Description

Key Features

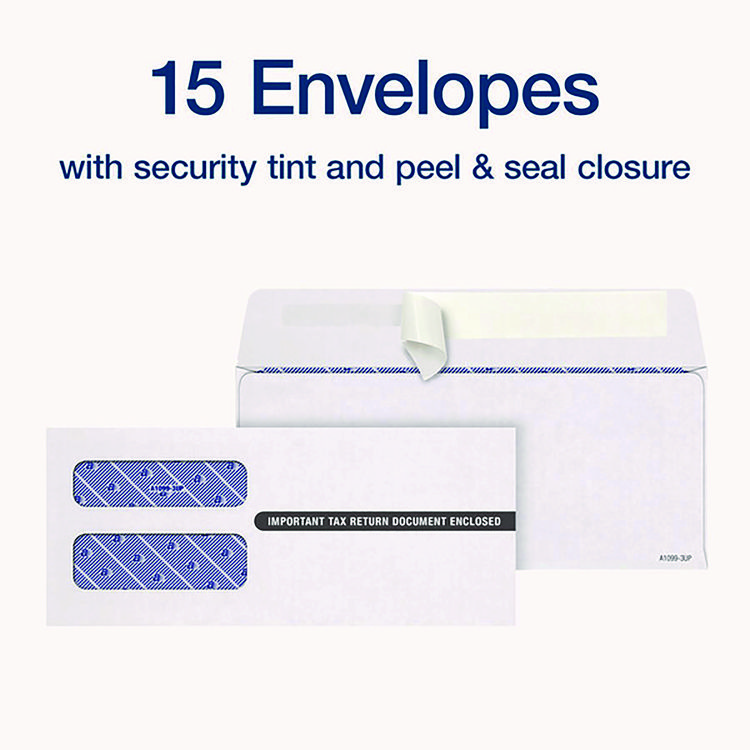

- 1099-NEC sets for laser/inkjet printers, 1096 summaries, security envelopes and access to Tax Forms Helper®.

- Use Form 1099-NEC to report nonemployee compensation.

- As of 2022, the 1099-NEC is a continuous-use form with a fill-in-the-year date field.

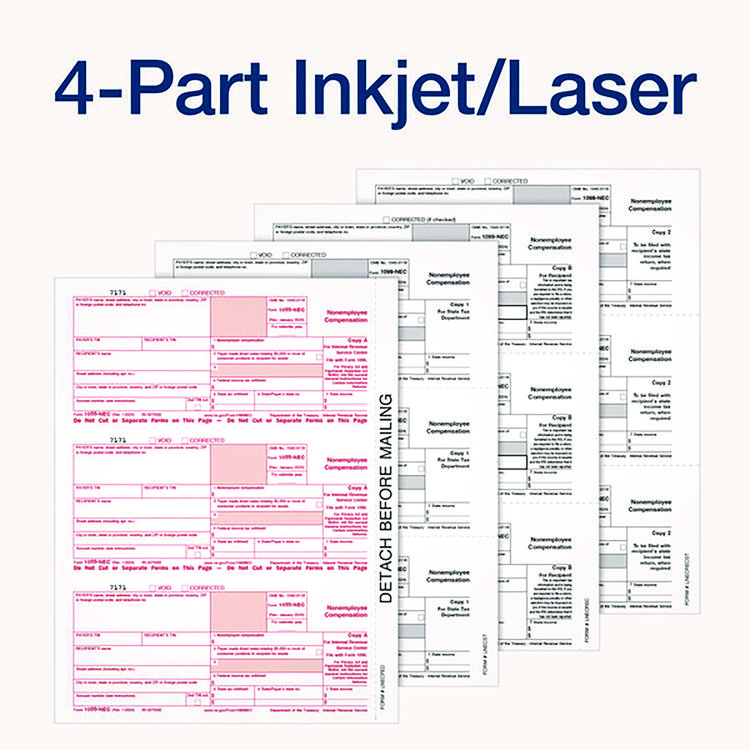

- Micro-perforated, 4-part carbonless sets (Copies A, 1, B, and 2) with IRS scannable red ink.

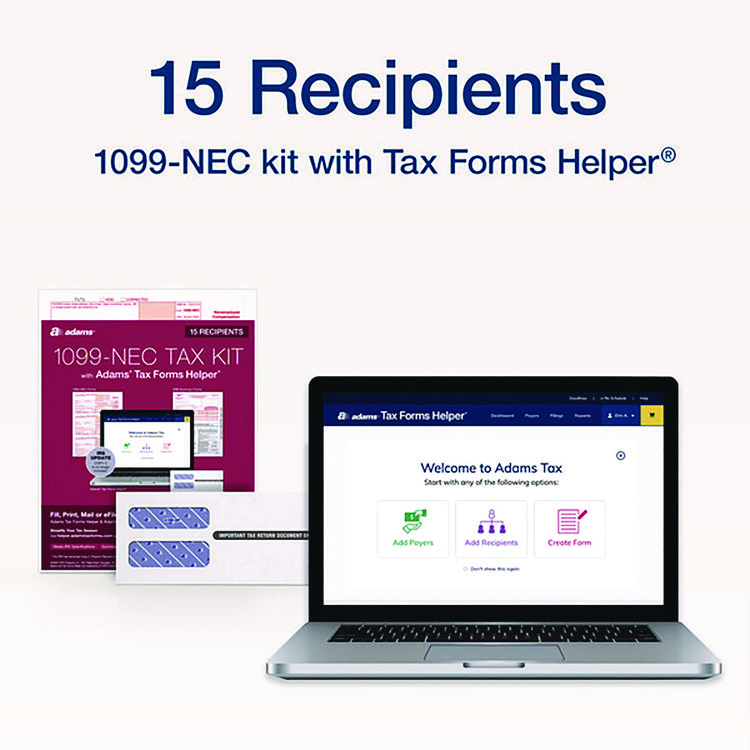

- Tax Forms Helper® with QuickBooks® connection—code and password enclosed in pack.

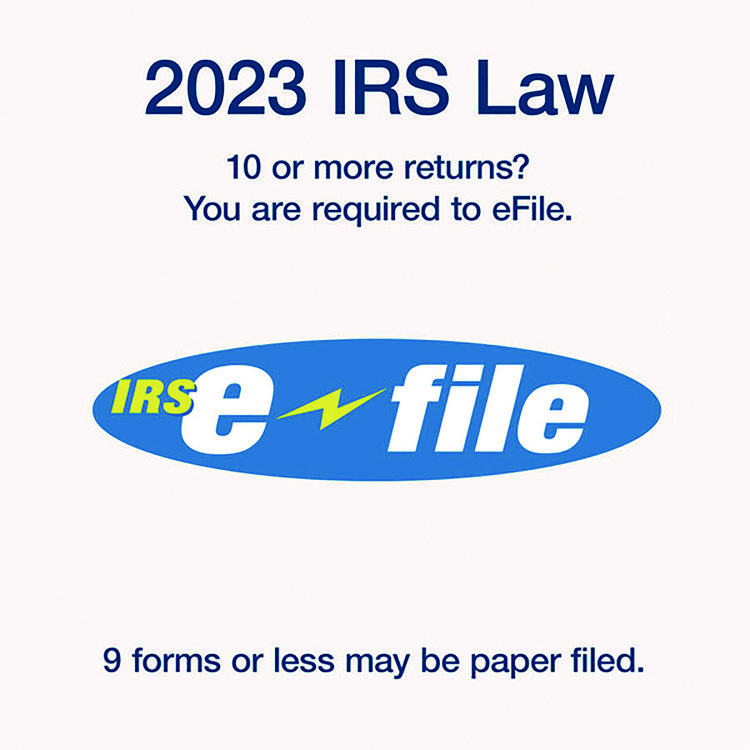

- 2023 IRS Law: if you have 10 or more returns, you must eFile—do so securely and easily with Tax Forms Helper®.

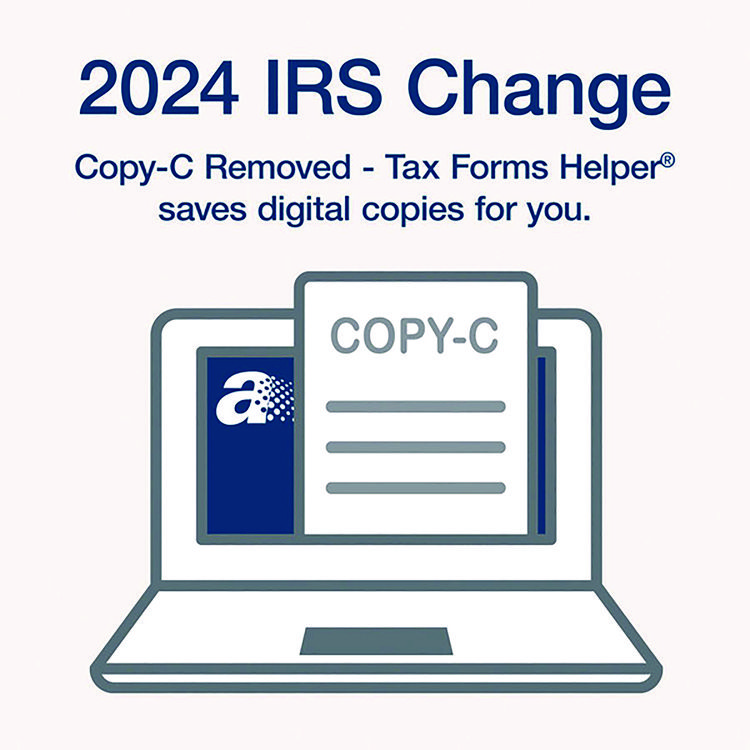

- As of 2024, Copy-C has been removed by the IRS—use Helper to save digital copies, too!

- Meets all IRS specifications—accounting software and QuickBooks® compatible.

- Get everything you need to report nonemployee compensation with four-part 1099-NEC form sets, 1096 summary forms, peel-and-seal security envelopes and access to Tax Forms Helper®. In just a few clicks, Tax Forms Helper® allows you to upload your 1099-NEC data directly from QuickBooks® Online or import your details from a previous year.

- Get everything you need to report nonemployee compensation: four-part 1099-NEC form sets, 1096 summary forms, peel-and-seal security envelopes and access to Tax Forms Helper®, the fast and easy way to file. In just a few clicks, Tax Forms Helper® allows you to upload your 1099-NEC data directly from QuickBooks® Online or import your details from a previous year. Use 1099-NEC forms to report nonemployee compensation paid to independent contractors and attorneys; and as of 2022, the IRS has made the 1099-NEC a continuous-use form with a fill-in-the-year date field, making it good for multiple tax years. Per the 2023 IRS eFile law, if you’re filing 10 or more forms, you’ll need to eFile, and Tax Forms Helper® makes it easy to comply with a secure IRS/SSA eFile system. Starting in 2024, the IRS has also removed Copy-C from the 1099-NEC, so use Helper to save digital copies, too!

- Get everything you need to report nonemployee compensation: four-part 1099-NEC form sets, 1096 summary forms, peel-and-seal security envelopes and access to Tax Forms Helper®, the fast and easy way to file. In just a few clicks, Tax Forms Helper® allows you to upload your 1099-NEC data directly from QuickBooks® Online or import your details from a previous year. Use 1099-NEC forms to report nonemployee compensation paid to independent contractors and attorneys; and as of 2022, the IRS has made the 1099-NEC a continuous-use form with a fill-in-the-year date field, making it good for multiple tax years. Per the 2023 IRS eFile law, if you’re filing 10 or more forms, you’ll need to eFile, and Tax Forms Helper® makes it easy to comply with a secure IRS/SSA eFile system. Starting in 2024, the IRS has also removed Copy-C from the 1099-NEC, so use Helper to save digital copies, too!

Specifications

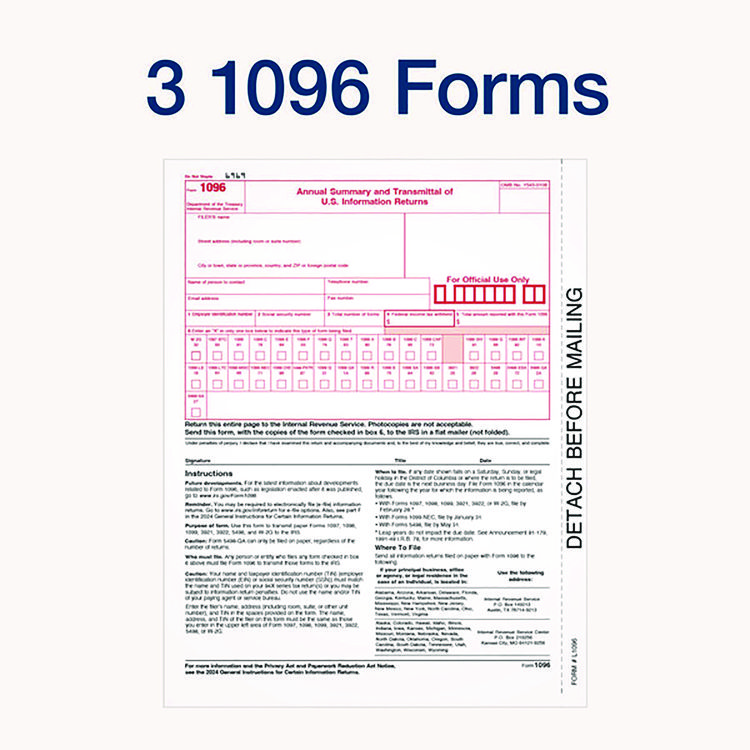

- Form Type Details: 1096

- Form Type Details: 1099-NEC

- Global Product Type: Tax Forms

- Dated: No

- Fiscal Year: 2024

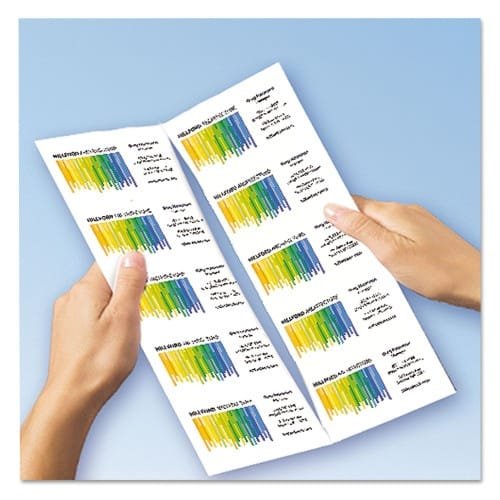

- Forms Per Page: 3

- Forms Per Page Layout: Vertical: Three Down

- Form Size: 8.5 x 3.66

- Sheet Size: 8.5 x 11

- Format Indicator: Unbound

- Form Quantity (Total): 15

- Copy Types: Four-Part Carbonless

- Principal Heading(s): 1099 NEC

- Paper Color(s): White

- Color Family: White

- Printer Compatibility: Inkjet

- Printer Compatibility: Laser

- Print and Ruling Color(s): Black

- Product Biodegradability Indicator: N

- Product Biodegradability in Days: 0

- Product Compostability Indicator: N

- Package Includes: (15) Envelopes

- Package Includes: (3) 1096 Summary & Transmittal Forms

- Compliance Standards: Meets or Exceeds IRS Specifications

- Pre-Consumer Recycled Content Percent: 0%

- Post-Consumer Recycled Content Percent: 0%

- Total Recycled Content Percent: 0%

Additional information

| Weight | 0.25 lbs |

|---|

Frankie Day (verified owner) –

Great experience overall. Smooth!

Raina Small (verified owner) –

A pleasure to use. Easy, quick!